If you are an X user, I highly recommend following Game of Trades. A few interesting posts from the last few days:

First up: credit card delinquencies.

When finances get tight, people prioritize what they are going to spend their money on. Oftentimes, things that aren’t tangible are the first to get a “skipped payment”. Credit cards are just that. It is “just a piece of plastic” in the wallet with no tangible impact in your daily life such as food and electricity, so punt the payment. Why are the credit cards at a high level that they cannot afford to pay them? Inflation. Living outside of their means. Emergency that required putting debt on a credit card. Loss of work and used credit cards to float a paycheck. Numerous reasons. We are seeing credit card delinquencies at an all time high which shows just how financially strapped and underwater that many people are. We are at a 50% delinquency rate, which is even higher than the financial crisis of 2008.

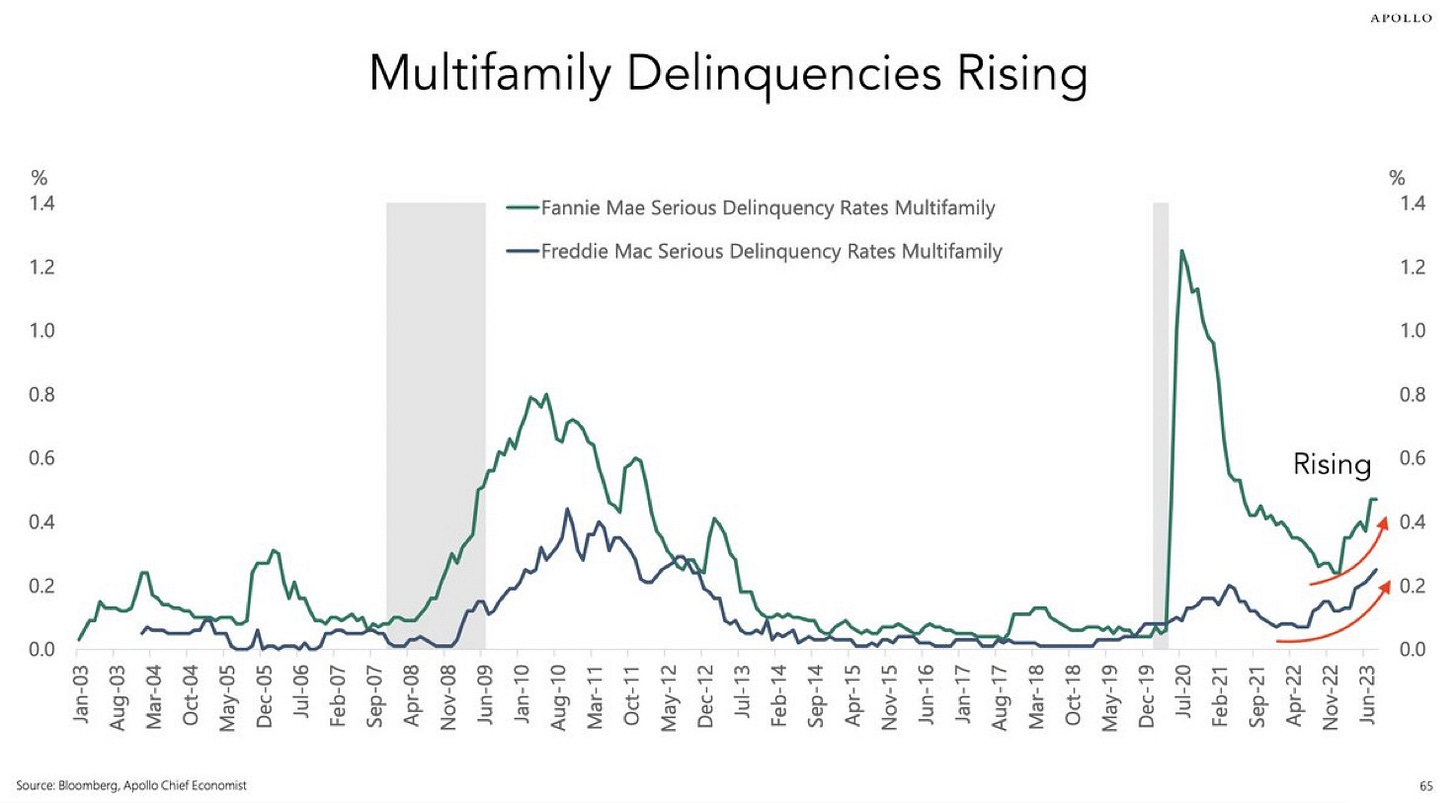

Second up: mortgage delinquencies

Interesting spike during the pandemic for Fannie Mae, but not Freddie Mac. Regardless, we started to notice increasing delinquency rates in the fall of 2022. Both companies are showing an upswing. This is concerning for several reasons. First, people generally let everything else go before their house. Housing is usually the one thing most people will protect at all costs. They will let credit cards go into default, a car get repossessed, take out HELOC loans agains the house to keep swimming for awhile……but when it gets to the point they cannot afford the house regardless, they start missing mortgage payments. Some people will just skip 1 mortgage payment to “get caught up” on other stuff and throw them into the delinquent category. However, this is a measurement of “serious delinquency” which means these are people that are 3+ months behind on their mortgage.

So we add up inflation making families struggle to pay for basic daily needs. Job wages stagnant and not adjusting for inflation. People use credit cards for basic purchases just to make ends meet. Pay the minimum payment and the balance and interest charges keep going up. If they purchased a house and or a car in the last 2 years, they bought 2 big ticket items at extraordinary inflated values. They are driving cars that aren’t worth what they paid for them, and living in a house that they paid more for than it was worth. They cannot get out of the house because 8% interest is not appealing to most homebuyers. And as we discussed last week, investment companies are dumping houses for much cheaper than the every day Jones’ can sell theirs for and get out from underneath it. If you can even find a buyer.

There is a home not far from me that is just a hair over a year old. Beautiful family home in a great location. It went on the market 2 weeks ago at DOUBLE what most of the homes here were built and paid for in 2020. They paid the huge bloated home value price. Based on when that house closed, they also missed the 2-3% interest window. They have already knocked $25k off the listing price to try and get rid of it. Another home a block from me tried to sell theirs at the bloated market price and it sat on the market for several weeks before they unlisted it. We live in a typical suburb neighborhood, this isn’t fancy pants estate mansion territory here. This is blue collar and white collar working families, mostly dual income families. Close to schools. Houses were selling in a day before the interest rate/price bloat phenomenon started. Another interesting factoid over here is that our subdivision isn’t completed. There is an entire third phase of development that just stopped completely in June 2022, the builders didn’t even bother to start breaking ground in it. The second phase of development is not complete yet, with several of those spec homes sitting on the market since summer 2022. The first phase of development has houses people are trying to sell at the inflated market price and they are either sitting forever, or they are massively reducing the asking price to sell it. Which, they can do, because we all bought houses before the market hike. They tried to sell at high market value and make a ton of money off their house. It didn’t work.

Speaking of bloated prices, there's a house for sale in our development for $325K. In 2016, it sold for $127,500 -- and now it's for sale at more than twice its sale price -- from seven years ago??? Looks like the same kitchen, very ordinary landscaping, no separate on-property storage (Florida, no basements, single floor homes). Two words: Good luck.

In central TX we began shopping for a pickup truck last month and they are moving off the lot so quickly they won’t negotiate below MSRP. These are $80k+ out the door. Maybe it is the lack of supply contributing but I was surprised knowing how the economy is going. We also had some friends in Austin put a house up for sale at the end of August for 1.35 million they bought for 800k in 2021 and it sold immediately for full price. A lot of pressure on the middle/working class while higher incomes are still doing well. People will start looking for the government to help and all they will do is make it a lot worse.