Life insurance payouts with Lincoln Insurance company were up 163% in 2021

Thank you to Margaret Menge and her crossroads report substack blog for this information!

Lincoln National, the FIFTH largest insurance company in the United States, reported a 163% increase in death benefits paid out under its group life insurance policies in 2021. To put that into perspective, the annual statements for Lincoln National Life Insurance Company show that the company paid out in death benefits under group life insurance polices a little over $500 million in 2019, about $548 million in 2020, and a stunning $1.4 billion in 2021. That is a 163% increase in payouts in 2021 over the previous years.

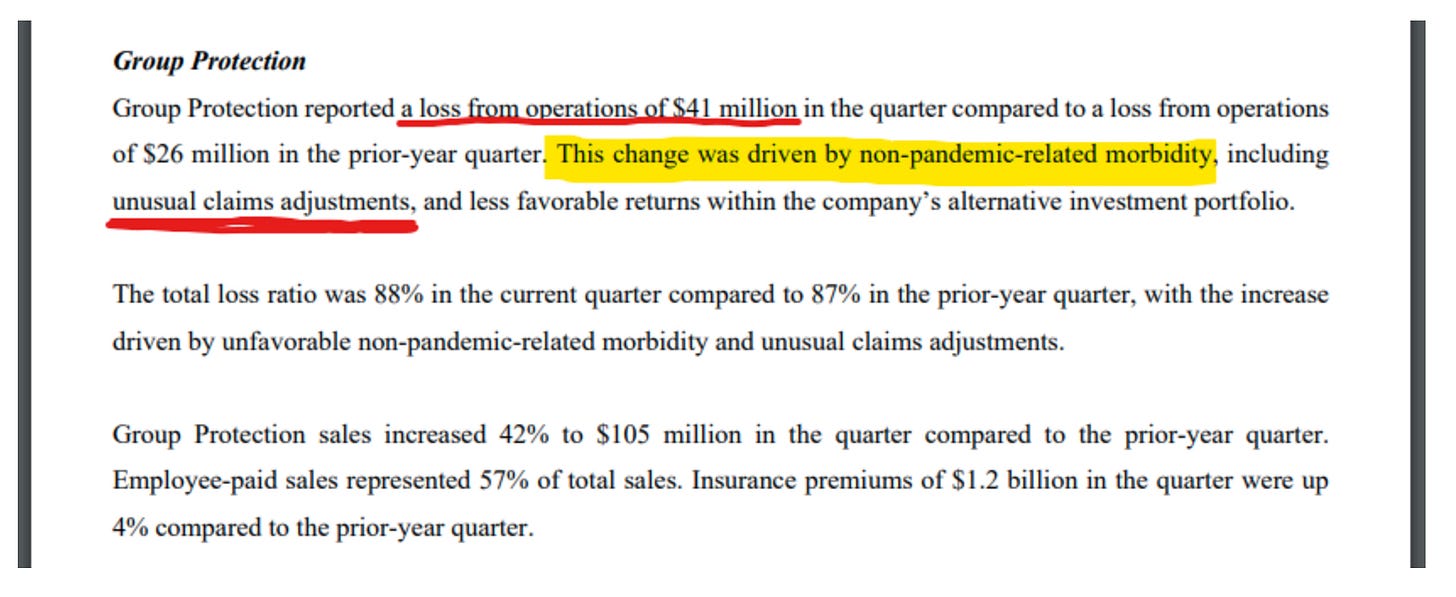

The answer to how to cover this excessive payout by Lincoln National is to raise the rates on new policies they write. They stated “This change was driven by non-pandemic-related morbidity [emphasis added], including unusual claims adjustments [emphasis added], and less favorable returns within the company’s alternative investment portfolio.” They clearly state that death and disability claims they have paid are NOT DUE TO COVID INFECTION, they are due to everything BUT covid infection. Hmmmmmm………what hit the market in 2021 that could possibly be contributing to death and disability in the group insured working population????? Rhymes with “Maxine”? If covid alone was the driver, we would have seen payouts go up in 2020, and in 2021 prior to Quarter 3-4. Q3-4 is July 1 - Dec 31. When did vaccines come out? Q1-2.

Lincoln Insurance Group not only paid out 1.4 billion dollars in 2021, but have a look at the above photo of quarter 1 in 2022! Quarter 1 of 2022 had a loss of $41 million dollars! They are clearly stating in their report that the excessive death payouts are NOT COVID VIRUS RELATED. Hmm. The stock market has been dropping so yes, their portfolio investments took a hit as well.

Sounds a lot like the One America company who reported 40-60% excessive claims payouts for 2021 quarters 3-4. That information came out last winter. They had the same report of excess death insurance payouts.

A few months ago I spent a few days discussing excess mortality and deaths. What we have to keep in perspective here is these group insurance plans are EMPLOYED WORKING PEOPLE. These are working age, typically very healthy, and decades of actuarial data tables know the risk of payout on this population well. Until 2021. Their actuarial tables got blown to bits. So much so that these insurance companies and actuarial companies are now revising their risk tables to stop the bleeding of payouts they did not intent to be making. Insurance is in the business of making money, not paying it out. As I said in previous posts, I will not be surprised at all if group life and disability insurance renewals in the future include a very specific question: “have you ever participated in a drug trial, and/or used an EUA medication including the covid vaccine”. Insurance premiums are about to sky rocket for that group.

Check out Margaret’s link…..she has the receipts for all of this data. It is fantastic information. I am curious to see what One America reports for excess death payouts for 2022!