Are you ready for centralized digital banking? The Fed is!

https://www.federalreserve.gov/newsevents/pressreleases/other20230315a.htm

https://explore.fednow.org/resources

In light of the great banking crash of SVB and others, the Fed is preparing to launch “FedNow”.

This is centralized banking through the Federal Government. They are pitching this as “oohhhhh instant payments! Instant gratification! Less fraud!! Learn your customers “behaviors” to meet their needs!”

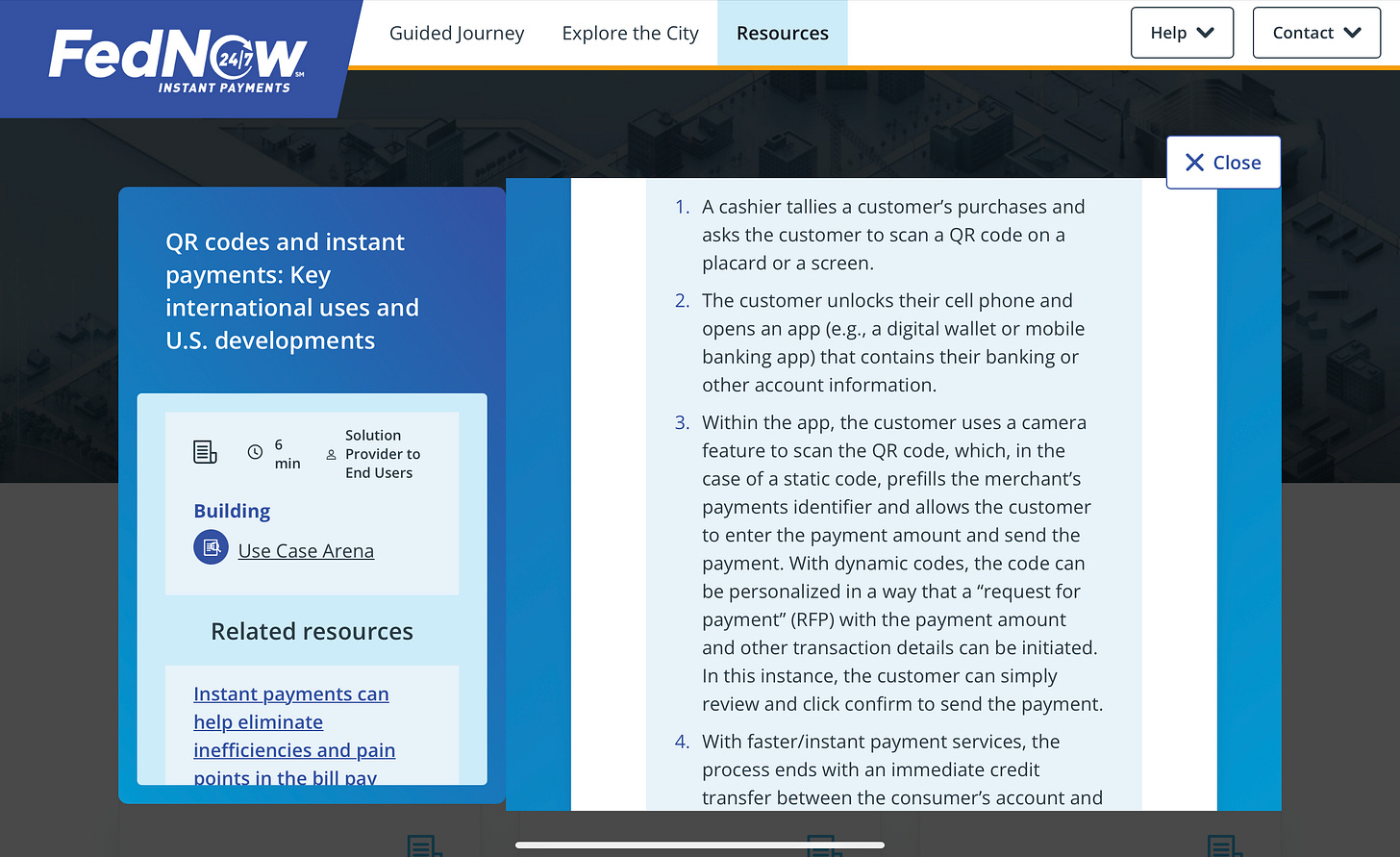

Then I see this:

Everything will be done via a QR code that the vendor has, you pull out your phone, scan the vendor QR code, and that QR code is attached to your bank account. Gee, what could go wrong HERE?!?!? This, my friends, is how we usher in the social credit system.

As it stands now, there is some element of privacy between you and your bank. If they opt to go centralized banking through the Federal Government, they can decide to shut off your ability to use your QR scanner to obtain goods. What info will they require you to input to get that QR scanner to work on your phone? Vaccine status? Daily temperature checks? Facial recognition showing you wearing a mask? They can set any parameter they want. They can deny payment to a vendor that they do not approve of. Or they can limit the amount of money you can spend with any business. I am sure Amazon will let you spend any money you want to, but the ammo store is going to have some imposed limit. This gives the government the ability to track everything you buy. I wonder if they have special lists for people who shop at certain places?

They plan to launch this in July 2023. That is 4 short months away. I am guessing it will start out innocently enough just like the vaccine campaign. “Oh we aren’t tracking you! Have you been denied the ability to do business anywhere? Heck no!” Just like “we aren’t going to mandate vaccines. It is your personal choice”. Give it 6-12 months at best and suddenly it becomes certain parameters and limitations to have access to your money. They can decide to delay payment. They can decide you spent too much somewhere and deny payment. They can force rules on you to use the money you worked hard to earn. Some will say “well I will just use cash”. Well, what if businesses go to “QR code payment only”? We would have a few limited businesses who refuse to go on the QR system, but how long before THEIR bank says nope, no QR, no more banking with us”.

The “pandemic” already revealed who is willing to comply and who wants the government making their decisions for them. Lets face it, it was not a great law of averages for the stand our ground freedom group. We were heavily outnumbered by those who willingly complied with every mandate and order thrown out that had zero legal basis behind them. Those of us who fought to remain unvaccinated know what these kinds of limitations look like. But this time around, it wouldn’t just be a job or a restaurant or traveling that they restrict you from doing. It could be every single commodity you purchase. Freedom would be extinct. This is not good.

Tomorrow, we will have a look at what Missouri is doing to enable this digital banking nonsense.

Secure from fraud? 🤣

Back in the mid 80s a very interesting little book "The Cuckoo's Egg" by Clifford Stoll, came out. It's a true story about how the "most secure computers/systems in the world, " weren't. It details the process of tracking and identifying the culprit. If you should get it, remember the context of the times.

My point is if a human can make it, another human can figure out how to get past it.

Many laugh at the "preppers" but they may end up being the truly smart people. If we don't have the necessities needed to barter, then we will have no means to survive without force or bowing to the system.

Not trying to sound "dramatic" but when people are cut off from the means to survive they will do whatever they need to. Those on the rural areas will be the safest, for a while. The cities will be chaos and will eventually head to the rural areas.

We need LESS government control of our lives, not more.

I mean what could go wrong? 🤔

This will not end well, IMO

It’s coming fast. SVB, Signature etc…. It’s a lead up to this. Note to how SVB took up the headlines so this news from the Fed went under the radar. Convid was a compliance test for THIS. Looks like they got the answer they were looking for and now its go time.