A non- healthcare topic today: what is getting ready to happen with the car market? Spoiler alert: repossessions are about to become a big problem

Totally off the usual topic of healthcare here. But I hope it may serve as an early warning for someone before they get themselves into a bad position.

As many people know, the car market has been NUTS for the last few years. Supply low, demand high, and most of it allegedly due to a “chip” that was in short supply, limiting the ability to produce new vehicles. Personally, I have patients who work for Ford and General Motors who spent more time furloughed than working in 2021. We watched the value of my husbands 2016 truck climb to a NADA price point that was 1.5 times higher than what he paid for it in 2019. The lovely county we live in even decided to change property taxes this year and INCREASE IT to be commensurate with the inflated value of vehicles. How does one change property tax on a depreciating item……when the inflated value for a year was false to begin with…..I have some strong foul words for that but that is a whole other issue. I digress.

Much like the housing market, the car market is quickly starting to correct. And much like the housing market, where people bought homes for exorbitant prices higher than their true value, people in the car market did the same thing. People bought cars at price points so high, that once the market began to correct, they were instantly “upside down” in equity. When you buy a $300k house for $614k, and the market comes crashing back to reality, you will be on average $100-200k in negative equity. Same goes for cars. That sensible sedan was priced $10K more than it is truly worth. Trucks were approaching double their normal value during 2021. Sadly, for both the housing and the car market, there were situations where delaying a purchase was not an option. If you totaled your car, or it combusted into flames in a parking lot, you had no choice but to buy a new vehicle at that inflated value.

So now we enter recession land. Cost of living is up. People bought a vehicle that was overinflated in price. Consumers know this. So they go to trade the vehicle in for something cheaper, smaller, correctly priced…..various reasons. When they get to the dealership, they quickly find out that they are in major negative equity land, and they either have to cough up thousands of dollars on a down payment, or keep driving their overinflated priced vehicle. What does this trickle down into? Car dealerships aren’t moving inventory, banks aren’t making money off car loans, etc.

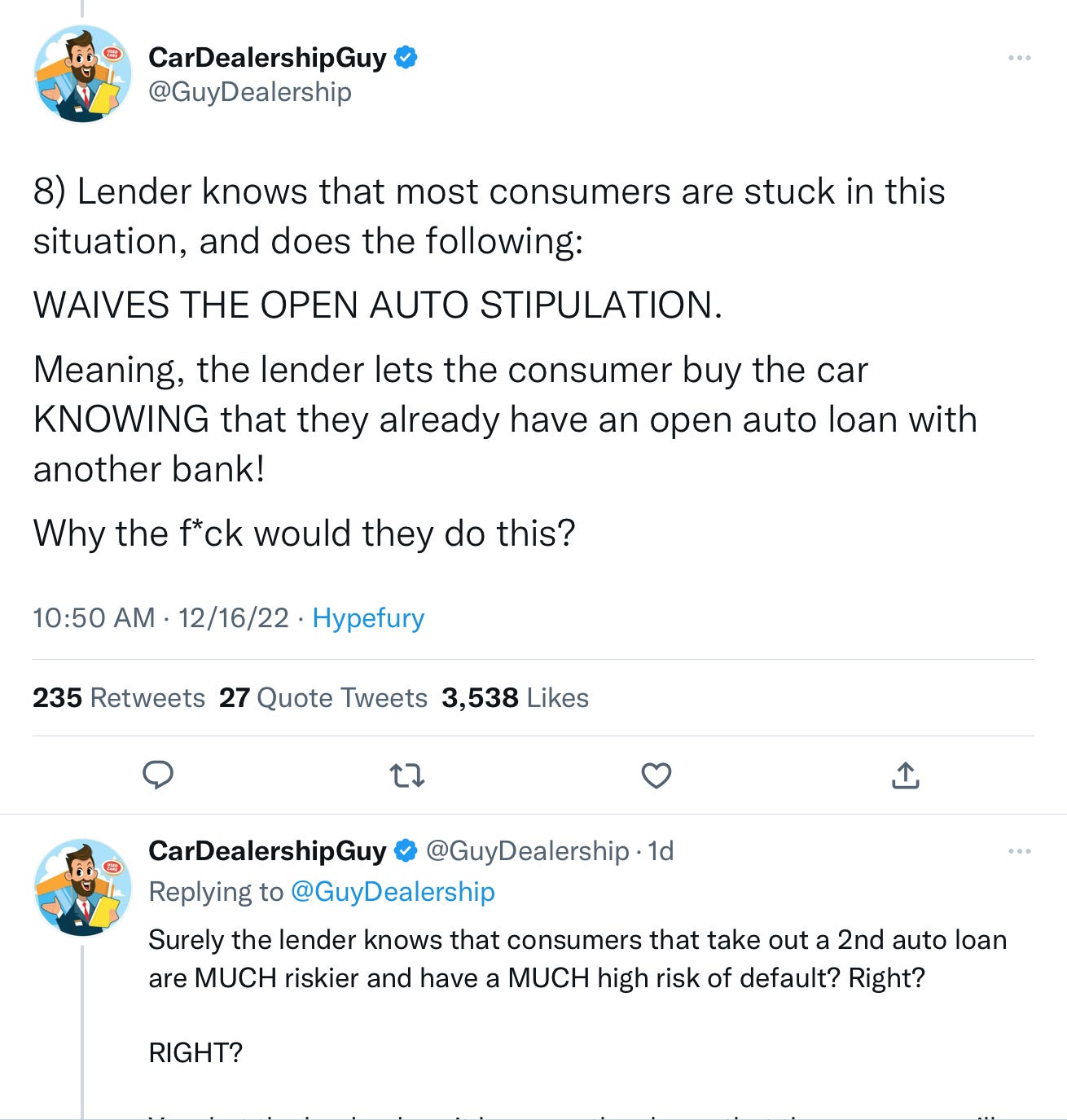

So what have the banks decided to do? Oh this is a doozy. In the dog eat dog world of car sales, banks have decided to allow this to happen:

The banks, in an attempt to avoid slumps in sales and new loans, are allowing consumers to take out a SECOND CAR LOAN and own TWO vehicles. Why are banks willing to take this risk on a new car purchase today?!? Because they know that the consumer isn’t going to default on the loan for the reasonably priced car they bought TODAY, they will default and go into repossession on the overinflated priced car they bought in 2021!!! The banks are acting in their best interest TODAY, despite it slitting the throat of the lender that financed a car for the consumer 18 months ago. As of Friday, December 16th, this twitter account reported that 9 of their current lenders were allowing consumers to buy a 2nd car and waiving the open auto stipulation.

What is open auto stipulation? Someone comes in to look at a car. They test drive, and then comes the “numbers sit down discussion”. They pull their credit. For most people, a single individual cannot afford more than 1 car loan in the debt to income ratio. For a married couple, that would be two vehicles in affordable range, but no adding a 3rd car loan. In typical times, banks require you to get rid of the original car and loan (trade the car in) on the new one so you only have 1 car loan at a time. This is protective to consumers so they do not go in over their heads with debt. And now, car lenders are WAIVING that protection mechanism, letting you add a 2nd or 3rd car loan to your profile, knowing that customers who are underwater in equity with high payments on that original car loan are not going to keep paying on both cars, most if not many cannot afford to do that, but in the desire to get your money and the sale, they are willing to gamble on your financial distress down the road, and when you decide to let the bank have that original car back, they trash your credit on a repossession, and you the consumer comes out in a worse situation while the banks and dealerships make money off of you.

My best advice? Do not fall for this scam. The beauty of a car loan over a house loan is this: its a few years temporary situation. Never go over a 5 year loan term. It may be tight right now, but if you get a repossession on your credit, your credit score tanks and you are no longer free to make the financial decisions you need to. You are at the mercy of high risk lenders charging way more interest and you end up, over time, paying much more in interest and financing for the next 5-7 years than you did on that overinflated car you bought in 2021. And your credit stays intact. I cannot believe banks are even willing to do this. It only hurts consumers. Read the entire twitter thread linked above. It is quite eye-opening!

The housing market is a whole other disaster waiting to happen.

Thanks to the blank check Joe regime, the 2023 automobile repossessions and housing foreclosure will make the 2008 subprime meltdown look like a pleasant day on a sunny beach.

I have an older truck that I use for work. It’s still reliable but starting to cost me in small repairs now and then. I’ve had people come up and offer to buy my truck several times, offering much more than it’s worth. Apparently trucks are in high demand and short supply. I began to check into purchasing a new truck and was shocked to find that both new and used trucks were priced much higher than I suspected. As a result, I decided to keep my old truck and avoid a astronomical vehicle payment. I see a storm on the horizon. Thanks for the information.